Source:

ChatGPT:

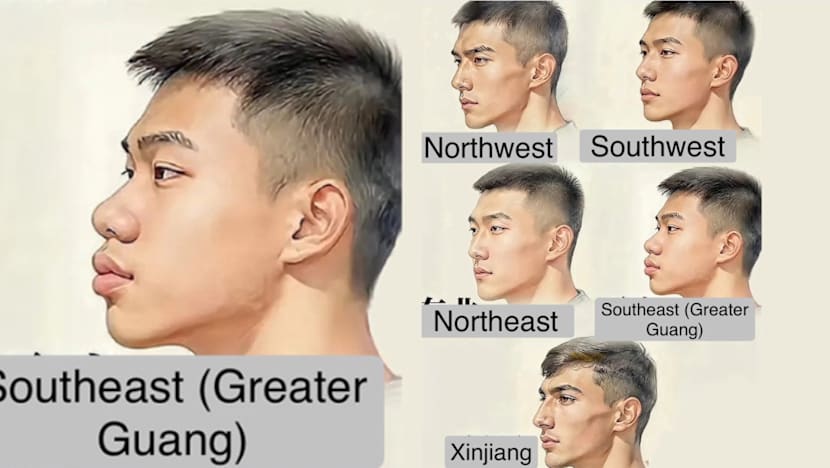

When the South China Morning Post (SCMP) highlighted the sketches, it posed a provocative question: Are Singaporean Chinese men the “least attractive”? The leap occurred because many early Chinese immigrants in Singapore historically came from China’s Southeast region. Singaporeans reacted almost instantly, flooding the comment section to reject the premise and roast the comparison.

One netizen questioned how Singapore was dragged into the conversation at all, noting that the sketches represent Chinese men from China, not Singapore’s diverse, multicultural population. Others responded with humour, taking playful jabs — including one referencing Hong Kong’s recent football loss to Singapore. Some Hong Kong commenters even defended Singaporean men, saying they encountered more attractive men in Singapore than back home, and reminding critics that both places share similar ancestral roots.

Still, opinions varied. While many dismissed the comparison as unnecessary and silly, a few commenters leaned into old stereotypes. One revived the familiar “prawn” insult — that Singaporean men have good bodies but less attractive faces.

Ultimately, reactions across both regions show the debate is less about objective looks and more about online culture, humour, and how easily viral content sparks cross-border chatter over subjective beauty standards.