Source :

Apple Intelligence :

• AI Adoption in Investing: Millennials and Gen Z are more likely to use AI for investing compared to other generations.

• AI Tools in Investing: AI tools for investing include robo-advisors, chatbots, and analytics engines.

• AI-Driven Investment Management: 41% of millennials and Gen Z would trust an AI assistant to manage their investments.

• AI Adoption in Investment: Millennials and Gen Zers are significantly more comfortable using AI tools for investment management compared to older generations.

• AI Usage in Personal Finance: A large percentage of Gen Zers and millennials utilize AI for managing personal finances, including saving, budgeting, and credit score improvement.

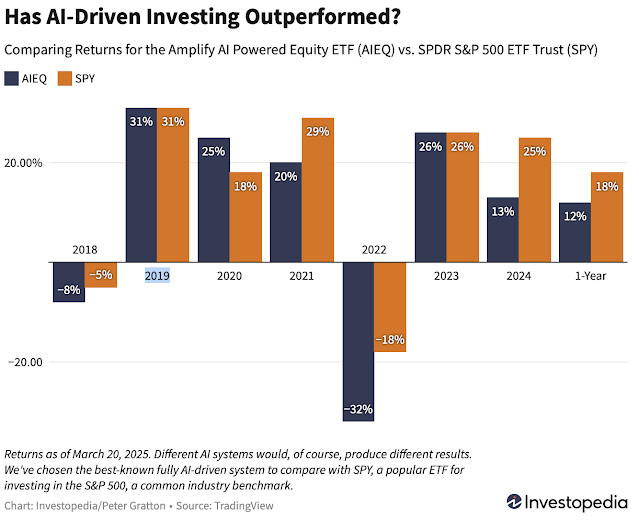

• AI-Powered Investment Tools: Retail investors have access to a variety of AI-enabled tools, such as robo-advisors, algorithmic trading bots, AI-powered ETFs, and AI assistants, to simplify the investment process.

• AI in Investment: AI tools like Kavout’s K Score use deep learning to analyze equities and investor sentiment.

• AI Benefits: AI can remove human error, process vast amounts of data, and provide personalized investment advice.

• AI Risks: AI models may struggle with unexpected market shifts, lack transparency, and pose data privacy concerns.

• AI in Personal Finance: AI is already being used in personal finance by Millennials and Gen Zers.

• AI-Powered Financial Tools: Robo-advisors, AI-powered ETFs, and AI research assistants are available for financial management.

• Limitations of AI in Finance: AI should complement, not replace, sound financial judgment.